What Exactly is a Pet Insurance Quote?

A Pet Insurance Quote is simply just an estimate of what it’ll cost to insure your pet. Similar to quotes for human health, car or home insurance, a pet insurance quote is tailored specifically to your pet. The amount you pay, known as the insurance premium, can vary depending on things like your pet’s breed, age, sex, and where you live. Plus, the level of coverage you pick will impact how much you will pay.

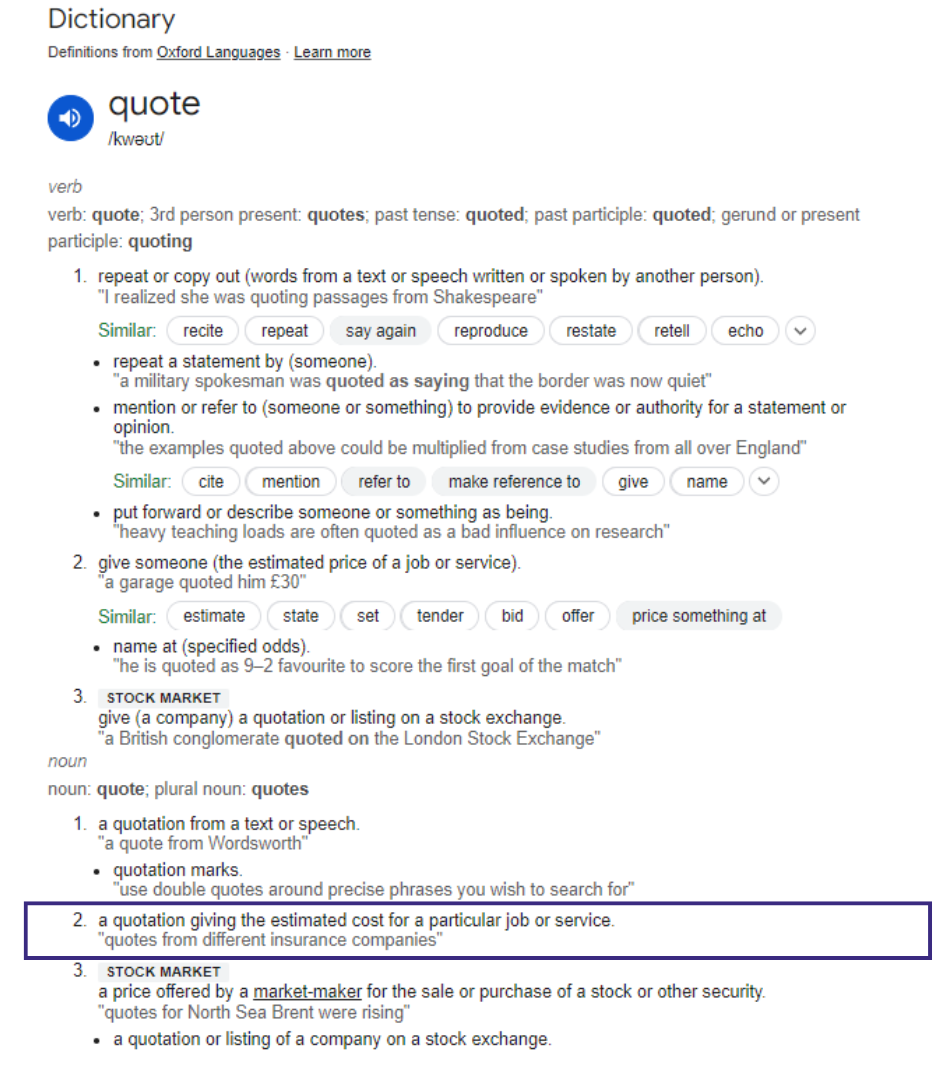

The full definition can be found here.

Why Comparing Pet Insurance Quote Matters?

According to CHOICE, Australia’s leading consumer advocacy group, comparing pet insurance policies is crucial because coverage, exclusions, and premiums can vary significantly between providers. They offer a comprehensive comparison of 78 policies from 28 insurers, featuring a big and versatile catalogue of different pet insurance providers in Australia. Importantly, CHOICE does not receive payments from the insurers it reviews, ensuring unbiased evaluations.

Similarly, Moneysmart, an initiative by the Australian Securities and Investments Commission (ASIC), advises consumers to compare the cover across different insurers. They emphasise checking aspects such as premiums, cover limits, policy excesses, and exclusions to ensure the policy meets your pet’s needs and your financial situation.

When shopping for pet insurance, we suggest gathering a few quotes while you’re shopping for pet insurance, so you can compare different policies and providers before making your final decision.

Independent sources like CHOICE and Moneysmart recommend this approach to ensure you find coverage that suits both your pet’s needs and your budget. By evaluating various options, you can make an informed decision and select the best policy for your furry friend.

What Affects the Cost of Your Premium?

Different insurance providers have their own way of calculating premiums, but they’re generally based on similar factors. At Petsy, we consider four main factors related to your pet, then adjust the premium based on your preferred coverage options. It’s worth noting that with Petsy, your own claims history doesn’t impact your premiums directly when it comes to renewal time.

Species and Breed

The breed of your pet can significantly impact the cost of your premium. Some breeds are more prone to specific health issues, which can make them a bit pricier to insure. Your pet’s health history prior to taking out pet insurance won’t impact your premiums with Petsy. Just like most other insurers, we don’t cover pre-existing symptoms and conditions and illnesses. You can read more about how we handle pre-existing symptoms and conditions differently at Petsy.

Pet’s Age

Generally, younger pets have lower premiums. As your pet gets older, the chances of health problems increase, which can lead to higher veterinary costs. At Petsy, we like to reward responsible pet ownership and pet parents who start early. So, if you begin your pet’s coverage with us before they’re 6 months old, we’ll automatically increase your annual limit by 20% at no extra cost. If you start before they turn one, we’ll add 10% to your annual limit, also at no extra cost.

Location

Where you live can also affect your premium. Vet costs can vary depending on whether you’re in an urban area or somewhere with a higher cost of living. Certain locations might also have higher risks for specific health issues or accidents, and insurers take this into account.

Sex of your Pet

The sex of your pet can influence behaviour, which might affect the likelihood of certain claims. There are also some statistical differences in health and lifespan between male and female pets, which insurers factor into their risk assessments.

Common Pitfalls When Comparing Pet Insurance Quotes

One common mistake when comparing pet insurance quotes is to base the decision solely on price and choose the option with the lowest premium. Not all pet insurance policies are created equal, so it’s important to compare policies properly, by comparing “apples with apples”, so you know what’s actually included (or not included) at the price point you are comfortable with. We can guide you on how to compare pet insurance policies.

Another mistake people tend to overlook is not reading the Pet insurance reviews of your pet insurance provider. Understanding other customers’ experiences can give you a good idea of how responsive an insurer is when it comes to claims, customer service quality, and whether the policy delivers on its promises.

To offer budget-friendly options, some providers might limit coverage through stricter exclusions or sub-limits, which can limit how much you can claim. These details may not be obvious when obtaining a quote. You may also be met with a hefty price increase when it comes to renewal time.

At Petsy, our focus is on providing high-quality coverage and service that offers long-term value. Our Australian-based team ensures you always speak with a local pet lover. Through our experience, we understand that more extensive coverage tends to align with our customers’ expectations. That’s why we focus on high-quality insurance with no sub-limits. Our customisable policy allows for coverage levels to be adjusted. For example, by increasing the annual excess, you will be able to lower premiums to meet your budget needs.

How Can I Lower My Pet Insurance Premium?

There are ways to lower your pet insurance premium by adjusting your coverage options, like the annual limit, benefit percentage, and annual excess. Generally, the more coverage you choose, the higher the premium. Here’s a quick rundown of the main factors:

Annual Limit

The annual limit is the maximum amount your pet insurance will pay for all claims in one year. Once this limit is reached, you’ll need to cover any additional costs yourself until the next policy year. The higher the limit, the higher the premium; the lower the limit, the cheaper or lower the premium. At Petsy, we offer a range of options, including $5k, $10k, and $25k, all with no sub-limits. Our pet insurance covers both accidents and illnesses and has one list of conditions covered under the policy regardless of the annual limit chosen by you. This means, even if you chose an annual benefit limit of $5,000 instead of $25,000, the list of conditions covered is exactly the same. It just means the total amount claimable in the 12-month period is $5k, not $25k.

Benefit Percentage

This is the percentage of each eligible vet bill your insurance will cover. Most options in the market range from 70% to 100%, but be sure to check the fine print for exclusions. At Petsy, we offer two options: 80% and 90%. You can lower your premiums by adjusting your benefit percentage. For example, choosing a plan that covers 80% of each eligible vet bill, rather than 90%, can help reduce your monthly premiums.

Annual Excess

This is the amount you have to pay out of pocket before your insurance starts covering costs. It can be a fixed amount per claim, per condition or per policy year. The lower the excess, the higher the premium; the higher the excess, the cheaper or lower the premium. Different insurers offer different types of excess, such as per claim, per condition, and annual excess. Ours is a once-off, annual excess that you’ll need to meet first. At Petsy, we have several annual excess options: $0, $150, $200, $300, and $500. We recently introduced the $500 annual excess option that can reduce the premium by more than 40% in some cases.

Optional Extra Benefits

Many providers, including Petsy, offer add-ons for extra benefits like Dental Illness, Specialised Therapies and Behavioural Conditions. If you decide to include extras, this will increase your premium, as coverage also increases. Petsy is one of the few providers that offer dental illness coverage with no sub-limits.

Vet Consultations

Removing vet consultation fees from your coverage can lower your premium. We are one of the few providers who allow for this, because many of our members are vets and pensioners who receive discounts on vet consultations, or they may already be covered by wellness plans and we don’t want them to double up. However, it’s worth noting that the cost of vet consultations can increase significantly during emergency hours. If you don’t fall into one of these categories, it might be worth considering including vet consultation fees in your coverage.

Examples of Pet Insurance Quotes with Petsy

When exploring pet insurance options with Petsy, you’ll find a range of pet insurance quotes based on your pet’s age, breed and current location. Below are a few examples of quotes to give you a good idea of what to expect when getting a pet insurance quote with Petsy.

Please note: these pet insurance quotes are taken on the 1st of June 2025, and are subject to change. For the most updated pet insurance quote price for your pet, please visit our quote tool. You can get a custom quote for your pet in less than 10 seconds.

Example 1

Pet Type: Dog

Location: BARANGAROO, NSW, 2000

Breed: Cavoodle

Sex: Male

Age: 1 year

Pet Desexed: Yes

Reimbursement: 80%

Vet Consultation Fees: No

Optional Extra Benefits: No

Annual Excess: $500

Quote as of 1st June 2025

| Annual Limit | $5,000 | $10,000 | $25,000 |

|---|---|---|---|

| Monthly Premium | $27.55 | $33.07 | $40.36 |

Example 2

Pet Type: Dog

Location: BARANGAROO, NSW, 2000

Breed: Golden Retriever

Sex: Male

Age: 1 year

Pet Desexed: Yes

Reimbursement: 80%

Vet Consultation Fees: No

Optional Extra Benefits: No

Annual Excess: $500

Quote as of 1st June 2025

| Annual Limit | $5,000 | $10,000 | $25,000 |

|---|---|---|---|

| Monthly Premium | $42.10 | $50.53 | $61.12 |

Example 3

Pet Type: Dog

Location: BARANGAROO, NSW, 2000

Breed: Miniature Dachshund

Sex: Male

Age: 1 year

Pet Desexed: Yes

Reimbursement: 80%

Vet Consultation Fees: No

Optional Extra Benefits: No

Annual Excess: $500

Quote as of 1st June 2025

| Annual Limit | $5,000 | $10,000 | $25,000 |

|---|---|---|---|

| Monthly Premium | $33.80 | $40.57 | $49.51 |

Example 4

Pet Type: Dog

Location: BARANGAROO, NSW, 2000

Breed: Labrador Retriever

Sex: Male

Age: 1 year

Pet Desexed: Yes

Reimbursement: 80%

Vet Consultation Fees: No

Optional Extra Benefits: No

Annual Excess: $500

Quote as of 1st June 2025

| Annual Limit | $5,000 | $10,000 | $25,000 |

|---|---|---|---|

| Monthly Premium | $43.19 | $51.84 | $62.57 |

Petsy Multi-pet Discount

Insuring multiple pets with Petsy has its perks! For every additional pet you add, you’ll get a 5% lifetime discount. This discount applies automatically when you insure more than one pet at the same time. If you’re an existing member and would like to add an additional pet to an existing policy or want to know about our latest promotions, feel free to give us a call at 1300 952 790.

So! Ready for Your Pet Insurance Quote?

Getting and understanding a pet insurance quote is a key step in finding the best coverage for your pet and peace of mind for you.

Comparing quotes across different providers ensures you’ll find a policy that balances affordability with the coverage your pet needs. Just be sure to watch out for potential pitfalls, like what’s included in the fine print or being guided purely on price. By carefully reviewing each quote and matching it with your pet’s specific needs and your budget, you can choose a policy that offers both great protection and value. Whilst you’re here, get a quote from Petsy and Happy shopping!

Get a free QuoteFAQs on Pet Insurance Quote

Is pet insurance worth it in Australia for dogs?

Absolutely, and here’s why every dog mum should seriously consider Petsy!

A Finder survey of 2,033 Australian pet owners revealed that the average dog owner is willing to spend up to $4,128 on their dog in one vet visit to ensure that their pet doesn’t have to be put down.

When you think about it, that’s potentially thousands of dollars you might need at a moment’s notice – and that’s just for one emergency!

Since around 10% of vet visits result in pets being put to sleep, having Petsy coverage can literally be the difference between life and death for your furry family member.

On average, annual vet expenses are estimated at $400 for dogs and around $270 for cats – and that’s before you factor in medications, surgery and emergency treatment according to CHOICE (December 2023).

With Petsy, you get that peace of mind knowing you won’t have to choose between your savings and your dog’s health when they need emergency surgery. We’re proud winners of Mozo’s Experts Choice Award 2024 for Exceptional Quality Pet Insurance and Canstar’s Outstanding Value awards for 2023 and 2024. When you compare pet insurance options and read pet insurance reviews, you’ll see why so many pet parents trust Petsy. Even our more affordable plans provide significant value when facing unexpected vet bills, making us a smart choice for the best pet insurance that fits your budget.

Who is the best pet insurance to go with?

We wouldn’t say “pick Petsy!” but what truly is important is the one that works best for your pet’s needs and your wallet.

What we can tell you is that Petsy Pet Insurance is the current customer satisfaction leader on large review sites as of June 2025, so our pet parents are highly satisfied with their experience. When choosing any provider, look for:

- Open communication

- Comprehensive coverage plans

- Employees who genuinely care about pets (not profits)

Always compare pet insurance policies side by side, read real customer feedback, and never fall for what appears to be inexpensive pet insurance if it does not have the coverage your pet is worth.

How much is pet insurance per month?

Great question! Petsy offers competitive monthly premiums that provide excellent value for comprehensive coverage. According to Finder’s 2025 analysis, Petsy sits in that sweet spot of offering quality coverage at fair prices.

As shown in an article in Yellow Pages, the cost of pet insurance in Australia typically ranges from $30 to $100 per month, depending on factors such as the type of pet, age, breed, coverage level, and location.

We’re proud that our pricing has contributed to winning Canstar’s Outstanding Value awards for 2023 and 2024!

When you get a quote with Petsy, you’re not just looking for cheap pet insurance, you’re investing in the best pet insurance that balances pet insurance coverage with affordable premiums.

Your pet’s age, breed, and where you live in Australia all influence your pet insurance quote, but our award-winning value means you’re getting the best coverage for your investment.

What is the best insurance to get a dog?

We believe Accident and illness coverage gives you the best protection for your pet!

Accident and Illness Cover: A pet insurance policy that covers both accidental injuries and illnesses. It can include coverage for a wide range of conditions, from minor issues, like infections and allergies, to more serious diseases like cancer.

Our policy covers hundreds and hundreds of Conditions, has reasonable waiting periods, and offers a stress-free claims process when you’re already worried about your furry friend. We’ve won Mozo’s Experts Choice Award 2024 for Exceptional Quality Pet Insurance because we focus on what matters, being there when you need us most.

Don’t just look for cheap pet insurance; with Petsy, you’re getting the best pet insurance that provides genuine peace of mind.

When you compare pet insurance policies, you’ll see why our policies offer fair pricing, and our Australian customer support makes us the smart choice.

Which breed of dog is cheapest to insure?

A Maltese Cross is typically the cheapest dog to insure ($956), according to our research from Finder’s 2025 analysis.

Generally speaking, small, spayed, female mixed breeds tend to be the most affordable to insure, according to industry data on insurance business.

The average cost to insure a purebred dog is $1,375, almost a third more expensive than it is for crossbreeds at $1,030, according to Insurance Business Australia. The research has found that larger breeds such as mastiffs, French bulldogs, British bulldogs, and Bernese mountain dogs are among the most expensive to insure, while smaller breeds, including terriers, schnauzers and Pomeranians typically have lower pet insurance premiums.

Even if you have a breed that typically costs more to insure, Petsy’s award-winning value (Canstar Outstanding Value 2023 & 2024) means you’re getting the best pet insurance coverage for your investment. When you compare pet insurance options with us, you’ll see why we are the choice of many Australian pet lovers.