The cost of pet insurance, also known as your premium, can be lowered by adjusting certain policy options, such as the annual limit, benefit percentage, and annual excess. Generally, selecting higher levels of coverage results in a higher premium, while opting for lower coverage can help to reduce the cost of pet insurance.

Here’s a quick breakdown of the key factors that influence pet insurance premiums and how adjusting them can impact the cost:

Annual Limit: A lower annual limit may reduce your premium, but it also decreases the total amount you can claim each year.

Petsy offers flexible options ranging from $5,000 to $30,000, all with no sub-limits. It’s important to note that a $10,000 annual limit without sub-limits isn’t the same as a $10,000 annual limit with restrictions.

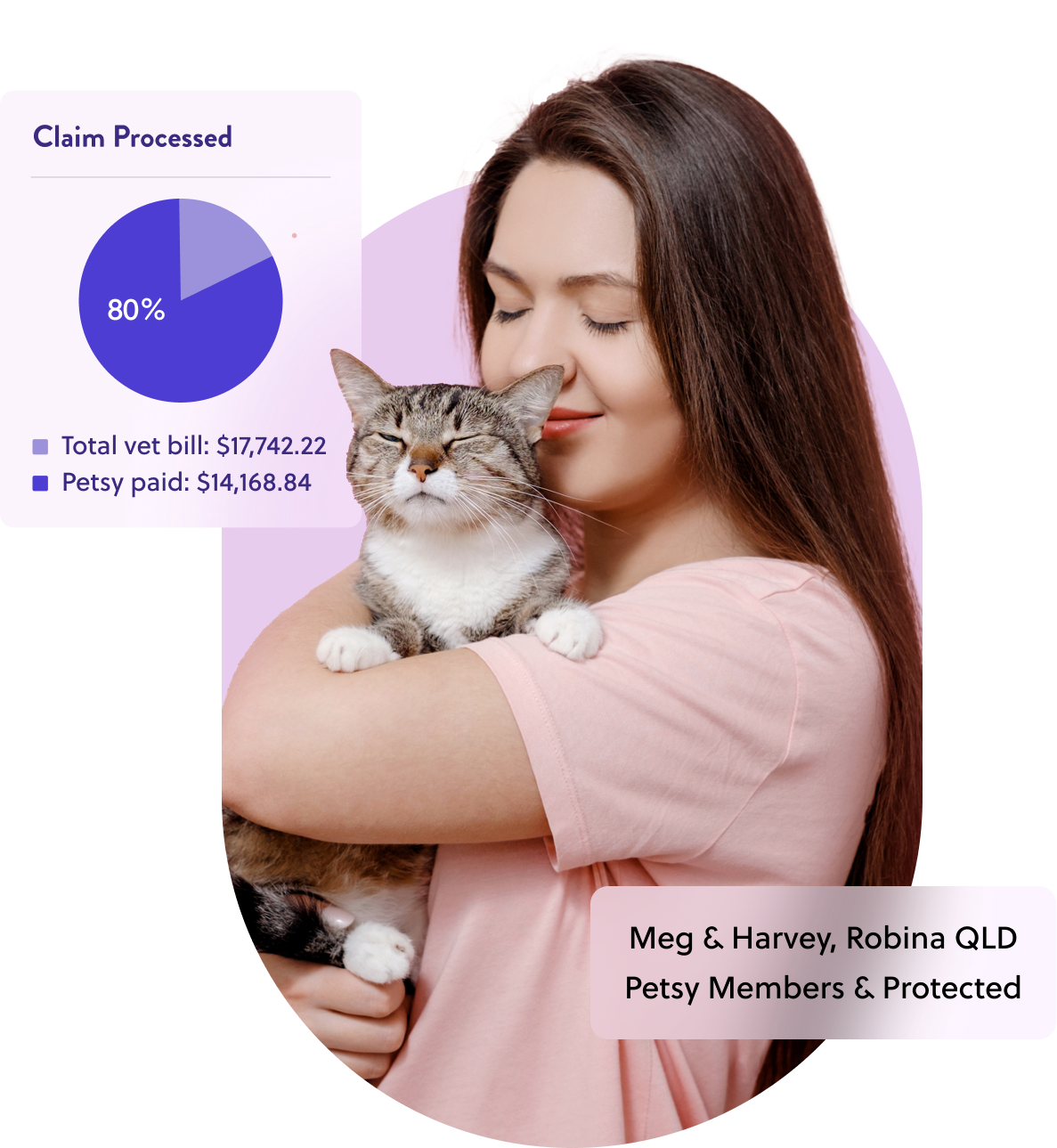

Benefit Percentage: Choosing a lower benefit percentage means you’ll receive a smaller portion of the vet bill back, which can reduce premiums.

Petsy Pet Insurance offers two options, 80% and 90%.

Annual Excess: Increasing your excess (the amount you pay before a claim is reimbursed) will help to lower your premium.

There are the three main types of excesses:

- Per Claim Excess: This applies every time you submit a claim, meaning you’ll need to pay the excess amount for each individual claim.

- Per Condition Excess: This applies once for each condition you make claims against, regardless of the number of claims you make for that condition.

- Annual Excess: This is applied once per policy year, no matter how many claims you make or how many conditions your pet develops during that time.

At Petsy, we offer a variety of annual excess options to suit your preferences and budget, including $0, $150, $200, $300, and $500. Please note that we only offer an annual excess, which is different from a per condition or per claim excess.

Optional Extra Benefits

Some pet insurance providers offer the option to include additional benefits in your policy, such as coverage for behavioural conditions, physiotherapy, or emergency boarding. It’s important to review what’s available in the market and consider whether these additional benefits align with your pet’s specific needs.

Selecting more optional extras (if available) will increase your pet insurance premium, while opting for fewer extras can help lower the cost.

With Petsy Pet Insurance, Optional Extra Benefits are extra things you can add to your pet insurance to help cover conditions and treatments that aren’t included as standard.

Optional Extra Benefits include:

- Vet costs for Dental Illness treatment (this doesn’t include regular dental check-ups and cleans)

- Vet costs for Behavioural Problems such as anxiety or aggression

- Special therapies for treatments that do not generally fall within the realm of conventional veterinary medicine, such as acupuncture or hydrotherapy

Over 80% of dogs and cats develop dental disease by the age of three. Although Petsy’s Optional Extra Benefits include coverage for Dental Illness, there’s no coverage if it is a pre-existing condition. Given pets aged three and older are likely to have pre-existing symptoms and conditions of dental disease (including gingivitis, plaque/tartar and calculus), we’ve set a three year old age limit for adding Optional Extra Benefits – you cannot add Dental Illness to your cover after your pet turns 3 years old – to reduce the chance of pre-existing condition exclusion applying to your pet, and to ensure our coverage genuinely serves the interests of pet owners.

Optional Extra Benefits can only be added when the policy is initially taken out or at the time of renewal, and so the last opportunity to add Optional Extra Benefits is when the pet is two years of age.

Dental Coverage

Adding dental coverage will increase the amount you pay for pet insurance. Choosing to exclude dental coverage will reduce the pet insurance premiums. Not many pet insurance providers have dental coverage as an option. If they do, there are usually sub-limits.

Petsy is proud to be one of the few providers that offer dental coverage with no sub-limits. We offer dental coverage as part of our Optional Extra Benefits, and it is available for pets under the age of three. This coverage includes treatment for dental illnesses and diseases such as gingivitis, abscesses, and periodontal disease. It does not cover routine or elective dental procedures, such as teeth cleaning.

Vet Consultations

Some pet insurance providers automatically include vet consultations in their coverage, often with sub-limits that can restrict how much can be reimbursed.

Not many pet insurance providers will allow you to remove vet consultations from your coverage. In fact, when it comes to vet consultations, many have a sub-limit on vet consultations. If you decide to remove vet consultations, this will make your pet insurance cheaper.

There are three main reasons why we allow our policy holders to remove vet consultations. The first is that we have many vets, vet nurses and other staff who work in vet clinics as our customers, and they usually get a large discount on vet consult charges. The second is that we have a number of elderly, disability and concession card holders as our customers who also get a discount on vet consults. The third is that our pet insurance pairs well with a wellness plan that covers vet consults fees.