Not All Pet Insurance is Created Equal

The world of insurance can be difficult to navigate, and pet insurance is no exception. In Australia, we’re fortunate to have a wide range of quality providers and policies to choose from. However, with so many options, it’s important to understand that not all pet insurance policies are created equal. The same claim made under different pet insurance policies may lead to significantly different outcomes. That’s why comparing pet insurance policies is essential to find the right balance among coverage, price, and value for your pet.

Why Would I Want Pet Insurance?

Even if you are a safe driver, you can’t control other drivers on the roads. This is why we get car insurance. You may say that you are a responsible and experienced traveller, but you cannot anticipate everything that happens whilst abroad. This is why we get travel insurance.

You may say that you are a responsible pet parent, but we cannot control what our pets are doing every moment of the day (especially the extra mischievous ones!). Even more so, we cannot have any foresight to know if our pet may develop a chronic condition or illness such as epilepsy or cancer. What is certain though, is that without pet insurance, 100% of the time in a pet emergency, you will have to pay 100% of the vet bill.

What is Pet Insurance?

Pet Insurance is a form of insurance available to pet owners to help cover their pet for accidental injuries and illnesses, by reimbursing a portion of the veterinary costs to treat their pet.

Pet insurance acts as a financial safety net, helping cover unexpected veterinary costs if your pet needs treatment. Some medical expenses can run into the tens of thousands, and having a pet insurance plan can significantly reduce the financial burden and stress during difficult times.

History & Evolution

Insurance for animals began in Sweden in 1890, when Claes Virgin wrote the first policy for horses and livestock. The pet insurance policy for pets like cats and dogs was first sold in Britain in 1947. By 2009, Britain had one of the highest rates of pet insurance, second only to Sweden.

In the U.S., pet insurance started in 1982, with the first policy issued to the famous TV dog, Lassie.

Pet insurance works a bit differently than health insurance for human — it’s more like property insurance. After your pet receives care, you pay the vet and then send a claim to your insurance company to get reimbursed.

One fun fact: Since 2009, the Hambone Award has been given each year to a pet with the most unusual insurance claim. Its name comes from an unnamed dog who reportedly was trapped in a refrigerator and suffered from mild hypothermia, eating an entire holiday ham while waiting for rescue.

Pet insurance policies can have different coverage limits: some have limits per condition, some have limits per condition per year, and others have one overall limit per year. This affects how much you can claim if your pet needs multiple treatments.

Pre-existing symptoms and conditions are often not covered, which is why it’s recommended to insure pets early before any health issues arise.

There’s usually a period of time when you can’t claim for accidents or illnesses right after getting a policy. This ensures coverage is for new injuries or illnesses that show up after you’re insured.

Pet Insurance Today

Today, pet insurance in Australia is becoming increasingly popular as more pet parents seek to protect their furry companions from unexpected vet bills. With a variety of pet insurance policies available, coverage can range from basic accident-only policies to more comprehensive options that include illnesses, routine care, and wellness treatments. Many Australian insurers now offer flexible plans with different benefit limits and extras, giving pet parents the ability to choose coverage that fits their budget and needs.

Understanding Pet Insurance

How Pet insurance Works: A Quick Overview

Pet insurance helps cover the cost of unexpected vet bills. After your pet receives care, you pay the vet, submit a claim, and get reimbursed based on your policy’s coverage. Policies usually cover accidents, illnesses, and sometimes routine care, depending on the plan. There are limits to how much you can claim, and pre-existing symptoms and conditions are generally not covered. Most policies also have a exclusion period before coverage kicks in for certain conditions. Pet insurance gives peace of mind by helping to manage unexpected medical costs for your pet.

In Australia, pet insurance typically offers several types of coverage. These can vary among different providers, but the main types include:

- Accident-Only Cover: This only covers costs related to injuries from accidental injuries, such as broken bones or wounds. It doesn’t cover illness-related expenses.

- Accident and Illness Cover: This is a more well-rounded coverage option that covers both accidental injuries and illnesses. It can include coverage for a wide range of conditions, from minor issues, like infections and allergies, to more serious diseases like cancer.

- Accident and Illness Cover with add-ons: Some plans also cover routine care treatments like vaccinations, desexing, and flea and tick treatments, along with accidental injuries and illnesses.

- Routine Care: Can be offered as an optional add-on, which helps to cover some costs for preventative care and wellness treatments, such as vaccinations, microchipping, and desexing. The coverage limits for these treatments are usually lower than for other claimable conditions.

How to compare Pet Insurance Policies

Why Compare Pet Insurance Policies

At Petsy, our mission is to ensure that pet insurance doesn’t end in tears. We’re here to educate you so you know exactly what you’re getting when you sign up. According to Moneysmart, pet insurance premiums typically range from $60 to $120 per month, which means there is a lot of variation of price and coverage in the market. Switching providers can be costly, especially if pre-existing symptoms and conditions are involved, so it’s crucial to find the right policy for you and your pet from the start. We strongly suggest shopping around for pet insurance quotes before you commit to a provider.

How to Compare Pet Insurance Policies

In Australia, there are many quality providers, each offering a range of policies. To make the best choice, it’s important to research and compare coverage options, costs, and how well each policy matches your pet’s health needs.

According to Google, the definition of compare is to “estimate, measure, or note the similarity or dissimilarity between”.

Full definition here

When comparing pet insurance policies, typically they have similar key components: inclusions/exclusions, an annual limit, benefit percentage, excess, and optional extra benefits. Your premium is determined, based on the levels of coverage depending on these components, as well as your pet and your address. So, when comparing pet insurance, the key is to understand how each component works differently across providers. This helps you identify the best policy that meets your needs and offers the most value.

Let’s break down these components so you can see where policies are similar and, more importantly, where they differ.

Coverage and inclusions

Most providers offer tiered policies, such as small, medium, or large, or bronze, silver, or gold and will try to bucket you into one of these categories. Generally, the lower-tiered policies offer less coverage and are more affordable, while the higher-tiered options provide broader coverage with fewer restrictions.

At Petsy, we understand that even two pet owners in the same suburb with the same breed of pet may have different financial needs. That’s why we do things differently here and offer one policy that is customisable to suit your coverage and financial requirements.

Annual limit

The annual limit is the maximum amount your pet insurance will pay for all claims in one year. Once this limit is reached, you’ll need to cover any additional costs yourself until the next policy year.

At Petsy, regardless of the annual limit you choose, the list of covered accidental injuries, illnesses, and conditions remains the same. Often with other policies, if you pick a larger annual limit, the list of your inclusions will also increase. At Petsy, no matter which annual limit you choose, the list of covered injuries, illnesses, and conditions remains the same. Whether you opt for a $5,000 or $25,000 annual limit, your coverage remains the same. Plus, unlike many other providers, we don’t impose sub-limits, so there are no restrictions on how much you can claim for specific conditions or claims.

Benefit percentage

This is the percentage of each eligible vet bill your insurance will cover. For instance, if your benefit percentage is 80%, the insurance will pay 80% of the bill, and you’ll pay the remaining 20% (after any excess is applied). This is pretty similar across the industry. Benefit percentage ranges from 70% to 100%.

Excess

This is the amount you have to pay out of pocket before your insurance starts covering costs. It can be a fixed amount per claim, per condition or per policy year.

At Petsy, our excess works a bit differently. Instead of applying an excess per condition or claim, we use a once-off annual excess. For instance, if your annual excess is $300 and your first vet bill is $200, the remaining $100 will be applied to your next approved claim. You only need to meet this excess once per year.

Optional extra benefits

Optional extra benefits are additional coverage options that can be added to the standard coverage. When doing your research, you will find that there are a lot of dissimilarities in the market for optional extra benefits. A lot of providers don’t even offer any optional extra benefits. You will find that some providers offer routine care as ‘add-ons’ and if they do, sometimes only offered as part of plans with the highest level of coverage.

At Petsy, we offer optional extra cover for dental illness, behavioural conditions, and specialised therapies. Plus, we don’t have sub-limits on these. However, it’s important to note that routine care items, like regular teeth cleaning, isn’t covered. Claims need to be related to a dental disease like gingivitis, periodontal disease, or tumours.

We offer optional extra benefits only for pets under the age of three at the time of application. Why only under three? By the age of three, most pets may develop dental diseases, and adding extra benefits later would mean these conditions would be considered pre-existing symptoms and conditions that would not be covered. We want to ensure you’re not paying for coverage that can’t be used.

Vet consultations

Vet consultation fees are what you pay your vet when your pet needs to see the vet for treatment when they’re sick or hurt.

When you receive a vet bill, one of the line items will typically be for the vet consultation. We’re one of the few providers that allows you to exclude vet consultations fees from your coverage. We do this for a few reasons:

- Many of our customers are vets, vet nurses, or clinical staff who receive significant discounts or don’t pay for vet consultations at all

- Some customers are already on wellness plans which cover vet consultation fees, so we don’t want them doubling up

- Pensioners often get discounts on their vet consultation fees

- It’s worth noting that the cost of vet consultations can increase significantly during emergency hours. If you don’t fall into one of these categories, it might be worth considering including vet consultations in your coverage.

Customer service and how a provider makes things easier for you

- Choosing a pet insurance isn’t just about the coverage—it’s also about how well the provider supports you when you need them most. Here are some things to think about:

- Is it easy to file a claim?

- How do they handle pre-existing symptoms and conditions?

- Can they bill your vet directly?

- How easy is it to reach their support team?

- What’s their cancellation policy?

- Can you add extras later?

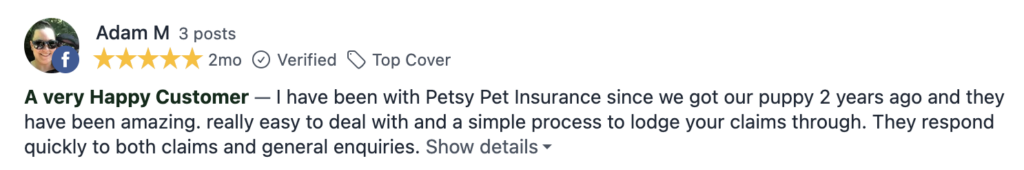

An easy way to check out a provider’s service is by looking at reviews on sites like ProductReview.com.au and Google Reviews. These platforms offer real feedback from customers, giving you a sense of how well the provider handles claims and customer support.

What Exactly is a Pet Insurance Quote?

A pet insurance quote is simply just an estimate of what it’ll cost to insure your pet. Similar to quotes for human health, car or home insurance, a pet insurance quote is tailored specifically to your pet. The amount you pay—known as the insurance premium—can vary depending on things like your pet’s breed, age, sex, and where you live. Plus, the level of coverage you pick will impact how much you will pay.

Full definition can be found here.

We suggest gathering a few quotes whilst you’re shopping for pet insurance, so you can compare different policies and providers before making your final decision.

What Affects the Cost of your Premium

Different insurance providers have their own way of calculating premiums, but they’re generally based on similar factors. At Petsy, we consider four main factors related to your pet, then adjust the premium based on your preferred coverage options. It’s worth noting that with Petsy your own claims history doesn’t impact your premiums directly, when it comes to renewal time.

- Species and Breed: The breed of your pet can significantly impact the cost of your premium. Some breeds are more prone to specific health issues, which can make them a bit pricier to insure. Your pet’s health history prior to taking out pet insurance won’t impact your premiums with Petsy. Just like most other insurers, we don’t cover pre-existing symptoms and conditions and illnesses.

- Pet’s Age: Generally, younger pets have lower premiums. As your pet gets older, the chances of health problems increase, which can lead to higher veterinary costs. At Petsy, we like to reward responsible pet ownership and pet parents who start early. So, if you begin your pet’s coverage with us before they’re 6 months old, we’ll automatically increase your annual limit by 20% at no extra cost. If you start before they turn one, we’ll add 10% to your annual limit, also at no extra cost.

- Location: Where you live can also affect your premium. Vet costs can vary depending on whether you’re in an urban area or somewhere with a higher cost of living. Certain locations might also have higher risks for specific health issues or accidents, and insurers take this into account.

- Sex of your Pet: The sex of your pet can influence behaviour, which might affect the likelihood of certain claims. There are also some statistical differences in health and lifespan between male and female pets, which insurers factor into their risk assessments.

Common Pitfalls when Comparing Pet Insurance Quotes

One common mistake when comparing pet insurance quotes is to have price as the deciding factor and simply pick the lowest premium option. Not all pet insurance policies are created equal, so it’s important to compare policies properly, by comparing “apples with apples”, so you know what’s actually included (or not included) at the price point you are comfortable with.

To offer budget-friendly options, some providers might limit coverage through stricter exclusions or sub-limits, which can limit how much you can claim. These details may not be obvious when obtaining a quote. You may also be met with a hefty price increase when it comes to renewal time.

At Petsy, our focus is on providing high-quality coverage and service that offer long-term value. Our Australian-based team ensures you always speak with a local pet lover. Through our experience, we understand that more extensive coverage tends to align with our customers’ expectations. That’s why we focus on high-quality insurance with no sub-limits. Our customisable policy allows for coverage levels to be adjusted. For example, by increasing the annual excess, you will be able to lower premiums to meet your budget needs.

How can I lower my pet insurance premiums?

There are ways to lower your pet insurance premium by adjusting your coverage options, like the annual limit, benefit percentage, and annual excess. Generally, the more coverage you choose, the higher the premium. Here’s a quick rundown of the main factors:

- Annual Limit: The annual limit is the maximum amount your pet insurance will pay for all claims in one year. Once this limit is reached, you’ll need to cover any additional costs yourself until the next policy year. The higher the limit, the higher the premium; the lower the limit, the cheaper or lower the premium. At Petsy, we offer a range of options, including $5k, $10k, and $25k, all with no sub-limits. Our pet insurance covers both accidents and illnesses and has one list of conditions covered under the policy regardless of the annual limit chosen by you. This means, even if you chose an annual benefit limit of $5,000 instead of $25,000, the list of conditions covered is exactly the same. It just means the total amount claimable in the 12-month period is $5k, not $25k.

- Benefit Percentage: This is the percentage of each eligible vet bill your insurance will cover. Most options in the market range from 70% to 100%, but be sure to check the fine print for exclusions. At Petsy, we offer two options: 80% and 90%. You can lower your premiums by adjusting your benefit percentage. For example, choosing a plan that covers 80% of each eligible vet bill, rather than 90%, can help reduce your monthly premiums.

- Annual Excess: This is the amount you have to pay out of pocket before your insurance starts covering costs. It can be a fixed amount per claim, per condition or per policy year. The lower the excess, the higher the premium; the higher the excess, the cheaper or lower the premium. Different insurers offer different types of excess, such as per claim, per condition, and annual excess. Ours is a once-off, annual excess that you’ll need to meet first. At Petsy, we have several annual excess options: $0, $150, $200, $300, and $500. We recently introduced the $500 annual excess option that can reduce the premium by more than 40% in some cases.

- Optional Extra Benefits: Many providers including Petsy, offer add-ons for extra benefits like Dental Illness, Specialised Therapies and Behavioural Conditions. If you decide to include extras, this will increase your premium, as coverage also increases. Petsy is one of the few providers that offer dental illness coverage with no sub-limits.

- Vet Consultations: Removing vet consultations fees from your coverage can lower your premium. We are one of the few providers who allows for this, because many of our members are vets and pensioners who receive discounts on vet consultations, or they may already be covered by wellness plans and we don’t want them to double up. However, it’s worth noting that the cost of vet consultations can increase significantly during emergency hours. If you don’t fall into one of these categories, it might be worth considering including vet consultations fees in your coverage.

Examples of Pet Insurance Quotes with Petsy

1-Year-Old Cavoodle

Location: Parramatta, NSW

Breed: Cavoodle

DOB: 23 September 2023

Sex: Girl

Benefit Percentage: 80%

Annual Excess: $150

Optional Benefits: Excluded

Vet Consultation Fees: Included

| Annual Limit | $5,000 | $10,000 | $25,000 |

|---|---|---|---|

| Monthly Premium | $41.09 | $48.32 | $57.87 |

Quote as at 23 September 2024

5- month old Labrador Retriever

Location: Parramatta, NSW

Breed: Labrador Retriever

DOB: 12 April 2024

Sex: Boy

Annual Limit: $12,000 ($10,000 plus $2,000 bonus at no extra costs)

Benefit Percentage: 80%

Optional Benefits: Included

Vet Consultation Fees: Included

| Annual Excess | $500 | $300 | $200 | $150 | $0 |

|---|---|---|---|---|---|

| Monthly Premium | $45.56 | $56.22 | $65.42 | $71.45 | $97.20 |

Quote as at 23 September 2024

Try out our quote tool to explore coverage options that fit your needs and budget.

The Importance of Pet Insurance Reviews

So, you’ve done your research, compared pet insurance quotes and maybe have one or two providers shortlisted. The policies look great, but how can you be sure you’ll want to stay with one provider for the long haul? Should you just pick a provider and hope for the best? Absolutely not! This is where pet insurance reviews come in handy.

What is a Pet Insurance Review?

In essence, a pet insurance review is a customer’s experience with their insurance provider that is shared online. These reviews offer insights into real experiences, particularly aspects like the claims process, customer service, and overall satisfaction—things you can’t fully judge from the policy details alone.

See full definition here.

What Can Pet Insurance Reviews Tell Me?

Reviews can be incredibly helpful for understanding key aspects of a pet insurance provider’s service. When it comes to the claims process, you’ll want to know: Was it easy to submit a claim? How long did it take to process? Were there clear explanations provided if a claim was denied? These details are crucial because they directly affect your experience when you need to rely on your insurance the most.

Similarly, customer service is another critical area to consider. Reviews can tell you how responsive and helpful the support team can be. Do they address concerns promptly? Are they knowledgeable about the policy details and able to guide you through tricky situations? Good customer service can make a huge difference, especially during stressful times when your pet’s health is on the line.

Not every review is going to be spot-on—sometimes, claims are denied for legitimate reasons, like pre-existing symptoms and conditions, but that can lead to unhappy customers. However, if you see the same issues popping up in multiple reviews, it might be a red flag.

Who Can Leave Pet Insurance Reviews?

Customers and the general public can share their experiences on sites like ProductReview.com.au, Trustpilot, or Google Reviews. In addition to customer feedback, financial and pet industry experts also contribute to reviews. Sites like Forbes Advisor offer professional assessments, focusing on coverage options, pricing, and policy details. These expert reviews can be especially helpful when you’re comparing multiple providers and need a deeper understanding of the policies. There is a lot of regulation around online product and service reviews, so that consumers can rely on the reviews they read online from reputable review sites.

What Should I Look for in Pet Insurance Reviews?

Here are key green and red flags to look out for. Example reviews below have been taken from Productreview.com.au as of 23 September 2024.

Green Flags:

Reviewers who recommend the provider to their family and friends indicate a high level of satisfaction.

Long-term Policyholders: Satisfied customers who have stayed with a provider for years can indicate reliability and trustworthiness.

Helpful Customer Service: Look for reviews praising knowledgeable and supportive service teams. This is particularly helpful when the unexpected happens and you need questions answered.

Happy Switchers: If someone switched providers and loves the new one, that’s a big plus.

Smooth Claims Process: Quick, hassle-free claims are exactly what you want.

Efficient Claims Process: Quick and straightforward claim submission and turnaround are major positives.

Red Flags to look out for in Pet Insurance Reviews

- Premium Increases: Bill shock is a real thing and not something you can foresee when you first take out a policy. As your pet ages and veterinary costs rise, it’s normal for insurance premiums to increase over time. Factors like inflation and changes in risk also contribute to these adjustments. When comparing providers, be aware that lower initial premiums are common, but it’s important to understand how premiums might increase over time due to factors like inflation and your pet’s age. Understanding how premiums might change over time will help you make an informed decision and avoid surprises.

- Repeated Complaints about Poor Customer Service: We totally get it – no one is perfect! But repeated reviews mentioning poor customer service, or poor communication where customers are left feeling confused is a sign that this could potentially be your experience too.

- Claim Denials or Low Payouts: This could mean the provider has restrictive limits like sub-limits on what they cover.

Petsy Pet Insurance

About Petsy Pet Insurance

Established in 2019, Petsy is a leading pet insurance provider in Australia offering extensive coverage and exceptional service to pet owners nationwide. With a deep understanding of the needs and financial circumstances of pet owners, Petsy aims to deliver peace of mind and support during unexpected veterinary emergencies. Petsy is committed to transparency and providing innovative solutions that prioritise the well-being of our beloved pets.

We offer coverage up to $30,000 annually to help cover eligible vet bills for pet owners if their pet runs into an unexpected mishap, with no sub-limits on any of the conditions you can claim.

With Petsy pet insurance, pet owners can rest easy knowing that expenses for costly vet treatments (and more) can be reimbursed, allowing pet parents to focus on their pet’s well-being instead of the financial burden. It also minimises the need to make difficult choices about a pet’s treatments, due to financial constraints.

Why Choose Petsy?

Petsy Pet Insurance is designed with your pet’s care in mind. Unlike many policies that cover only specific conditions, Petsy covers almost every type of accidental injury, illness, or condition, unless it’s specified as not covered under the policy (you can refer to these in the General Exclusions section in the PDS).

We have no sub-limits on the conditions you can claim, meaning you won’t face unexpected restrictions on your coverage, and our excess is an annual excess (per year), not per condition or per claim like some others, which can help to lower unexpected out of pocket expenses.

Plus, if you insure your puppy or kitten with Petsy before their first birthday, you’ll receive an annual limit bonus that will continue after the renewals of the policy.

How we take care of you and your pet

Pet parents have praised us for providing top-notch coverage with best-in-class customer support.

We’ve won Canstar’s Outstanding Value Pet Insurance Award for two consecutive years for 2023 and 2024, and the majority of online reviewers have given us a 5-star rating.

How do we stand above the pack?

- We don’t place sub-limits on claims, even as your pet gets older.

- Flexible annual excess options, including $0 excess

- Forbes Advisor’s pick of the best comprehensive pet insurance policy

- Canstar’s 2023 and 2024 Winner for Outstanding Value Pet Insurance

- Highly Commended in Finder’s Pet Insurance Awards 2023 for Value and Comprehensive Pet Insurance

- Best for Value Pet Insurance and Best for Young Pets by WeMoney Awards 2024

- Finalist for Pet Insurer of the Year by WeMoney Awards 2024

- Exclusions for temporary pre-existing symptoms and conditions are reviewable

- Optional dental illness coverage for pets younger than 3 years old

- Annual limit bonus for pets younger than 1 year old

- Discount for veterinary professionals

- Shorter exclusion period for illness

How Petsy Stacks Up: A Detailed Comparison

| Petsy Pet Insurance | Typical Competitor | |

|---|---|---|

| Pet insurance specialist | ✅ | ❌ |

| More customisable coverage | ✅ | ❌ |

| Cooling off period | 30 days | 21 days |

| Shorter exclusion period for illness conditions | ✅ 14 days | ❌ 21 days |

| Pre-existing condition assessment | ✅ | ❌ |

| Annual limit bonus for young pets | ✅ | ❌ |

| Local support team | ✅ | ❌ |

| Pay the vet direct option | ✅ | ❌ |

| Claim via phone | ✅ | ❌ |

| Multipet discount | ✅ | ❌ |

| Cover for vaccine preventable diseases if pet is up to date with vaccinations | ✅ | ✅ |

| Minimum entry age for cover | 6 weeks | 8 weeks |

| Payment reminders | ✅ | ❌ |

Pet Insurance Coverage

| Petsy Pet Insurance | Typical Competitor | |

|---|---|---|

| Min age for entry | 6 weeks | 8 weeks |

| Max age for entry | 9 years | 8 years |

| Annual excess | ✅ | ❌ |

| Excess type | Per year | Per condition |

| No sub-limits on inclusions | ✅ | ❌ |

| No sub-limits on after hours emergency vet visits | ✅ | ❌ |

| No sub-limits on hereditary and congenital conditions | ✅ | ❌ |

| $0 excess available | ✅ | ❌ |

| Cover for vaccine preventable diseases if pet is up to date with their vaccinations | ✅ | ❌ |

| Optional coverage available for dental illness for pets younger than 3 years | ✅ | ❌ |

| No sub-limits on dental illness | ✅ | ❌ |

| Optional cover available for specialised therapies for pets younger than 3 years | ✅ | ❌ |

| Optional cover available for behavioural conditions for pets younger than 3 years | ✅ | ❌ |

| Coverage for temporary pre-existing symptoms and conditions, available after a period of time | Can be as short as 2 months depending on the severity of the condition | 18 months |

| Option to exclude vet consultations for veterinary professionals | ✅ | ❌ |

What’s covered and what’s not: A Clear breakdown

| Accidental Injuries | Illnesses | Diagnostics & treatments |

|---|---|---|

| ✅ Car accidents | ✅ Cancer | ✅ Hospitalisation |

| ✅ Heatstroke | ✅ Diabetes | ✅ Emergency care |

| ✅ Broken bones | ✅ Ingestion of foreign objects | ✅ Surgery |

| ✅ Fractures | ✅ Tick paralysis | ✅ X-rays |

| ✅ Snake bites | ✅ Skin conditions | ✅ Medication |

| ✅ Allergic reactions | ✅ Ear and eye conditions | ✅ Diagnostic tests |

| ✅ Bite and fight wounds | ✅ Liver disorders | ✅ Blood tests |

| ✅ Soft tissue injury | ✅ Gastro intestinal disorders | ✅ CT scans |

| ✅ Poisoning | ✅ Heart disease | ✅ MRIs |

| ✅ Burns | ✅ Neurological disorders | And more |

| And more | And more |

| Petsy Pet Insurance covers what some other providers charge extra for or don’t cover at all. | ||

|---|---|---|

| Dental illness for pets younger than 3 years old | Overseas Pet Travel Insurance (in New Zealand or Norfolk Islands on trips < 60 days) | Emergency boarding with no sub-limits |

| See what the experts are saying | ||||

|---|---|---|---|---|

“Our Pick of the Best Comprehensive Pet Insurance Policy” | Rated “Excellent” on Trustpilot | Winner “Outstanding Value Pet Insurance” | Rated 4.8 on Product Review | Winner Best for Value Overall and Best for Young Pets – Pet Insurance |

Why Petsy?

- Pick any vet

- No sub limits

- Quick and easy claims

- We cover treatments that some don’t

Pet ownership can be expensive, but it can be worse if your pets get sick and require emergency treatment. For peace of mind when the unexpected happens, many veterinarians recommend pet owners to consider pet insurance.

Want someone else to help pay for unexpected vet bills? With Petsy, we can help.

Plan Options

Petsy Pet Insurance is an insurance policy that reimburses 80% or 90% of vet costs for the treatment of your pet if they suffer an unexpected injury or illness (provided these occur after any applicable exclusion period has ended symptom free).

We offer coverage up to $30,000 annually with no sub-limits on any of the conditions you can claim.

Our policy is customisable -you’ll be able to tailor your cover by choosing your preferred level of Benefit Percentage, Annual Limit, Annual Excess, and choosing whether you’d like to choose Optional Extra Benefits (if your pet is less than 3 years old) and whether you’d like to include costs of Vet Consultations for your cover.

| Benefit Percentage | 80% or 90% |

|---|---|

| Annual Limit | $5,000, $10,000 or $25,000 |

| Annual Excess | $0, $150, $200, $300, $500 |

| Optional Extra Benefits | Include or exclude |

| Vet Consultations | Include or exclude |

Starting early with Petsy Pet Insurance has its perks. For pets starting their protection with us before they’re 6 months old, we’ve topped up your chosen annual limit by 20% and you pay nothing extra.

That’s an extra $1,000 on a $5,000 plan

Or an extra $2,000 on a $10,000 plan

Or an extra $5,000 on a $25,000 plan

For pets starting their protection with us before they turn one, we’ve topped up your chosen annual limit by 10% and you pay nothing extra.

That’s an extra $500 on a $5,000 plan

Or an extra $1,000 on a $10,000 plan

Or an extra $2,500 on a $25,000 plan

Petsy offers coverage for puppies and kittens, adult dogs and cats, and senior dogs and cats (if the policy is taken out before they turn 9 years old).

We currently offer Petsy Pet Insurance in every state, territory and city in Australia and work with any licensed vet in the country.

How to Set up a Policy

Getting a quote for your pet insurance is quick and easy and only takes a few minutes. Get a quote online by visiting our website at petsy.com.au. Fill in the details about your pet and follow the prompts. Alternatively, if you prefer to speak with someone, our friendly team is available to assist you over the phone at 1300 952 790.

Our policies are customisable. You can choose the level of coverage that suits your needs, including the benefit percentage, annual limit, and annual excess. Plus, you can decide if you want to include vet consultation costs in your cover. For pets under three years old, you also have the option to add Optional Extra Benefits.

When you complete an online quote, you’ll see a summary of the coverage options. You can select a preferred start date that is within 30 calendar days for your policy to commence. Once you make your payment, you’ll receive a confirmation of your coverage and your policy documents via email, ensuring everything is set for your pet’s protection.

Pre-existing Condition Assessment and Waiver Forms

What is a pre-existing condition assessment?

A Pre-existing Condition Assessment is a medical assessment of your pet’s complete vet history by a vet to determine whether your pet has any pre-existing symptoms and conditions that are excluded from the cover. We offer a pre-existing condition assessment to provide transparency on coverage upfront and it also helps to fast-track any future claims process.

Here’s what to expect during the assessment process:

Collecting Medical Histories: We’ll reach out to the vets you’ve listed to gather your pet’s medical records. This step typically takes 5-10 business days, depending on how quickly we can obtain the information from your vets.

Reviewing Records: Once we have all the necessary information, we’ll review your pet’s medical history to identify any pre-existing symptoms and conditions and assess whether they’re temporary or chronic. We’ll determine if these conditions could be eligible for coverage in the future and inform you of how and when you can request a review, including any supporting documentation needed from your vet.

Updating Your Coverage: If our assessment results in changes to the status of any pre-existing symptoms and conditions, we will update your Certificate of Insurance accordingly.

Please note, lifting exclusions for reviewable pre-existing symptoms and conditions isn’t automatic. Exclusions will only be removed with sufficient medical evidence that confirms the condition has been successfully treated, cured or resolved. Conditions deemed non-reviewable will remain permanently excluded from coverage.

We aim to complete a pre-existing condition assessment for every member, but there are rare cases where an assessment might not be possible — for example, if medical records are incomplete, previous vet practices are closed or unreachable, or if shelter records are limited. In such cases, we will evaluate the information available at the time of your first claim.

For pets without any medical history, we recommend scheduling a medical check-up and using a request for waiver form to help establish a medical record for the assessment.

Once your policy is set up, you can take a copy of the Waiver Form to your next vet visit and apply to reduce the exclusion period for Specified Conditions by returning the completed form to us (within 14 days of your visit).

Pre-approvals and Vet Payment Options

What is a pre-approval?

A pre-approval refers to an approval of a potential future claim that is assessed before treatment, not after. Pre-approvals are advisable for policyholders anticipating upcoming high-cost treatments

To process to obtain a pre-approval, we need:

- An estimate of itemised costs for the procedure

- A description of the required procedure

- Clinical history related to the procedure (a brief email from a vet is not sufficient)

The minimum requirements to process a pre-approval include:

- A completed pre-existing condition assessment

- An estimate received from your vet before 2pm AEST Monday to Friday

- The exclusion periods on a policy must have ended for the condition

Additional Considerations

To determine if a pre-approval can proceed, we also review the following:

Policy Start Date

- Confirm the treatment is not related to a pre-existing condition that existed prior to the policy start date.

- Ensure the exclusion periods for the policy have passed for the condition.

Pre-existing Condition Assessment

- If no assessment has been completed, a pre-approval cannot be provided.

- If an assessment has been completed, check:

- Whether the condition is listed as pre-existing.

- The timing of the assessment (e.g., before or after the end of exclusion periods).

Current Hospitalisation

If the pet is currently hospitalised, pre-approval may not be possible due to the rapid pace of charges. Delays in treatment while waiting for approval isn’t recommended.

Risk of Euthanasia

If the pet is at risk of euthanasia, we pause the pre-approval process and escalate the case to the head vet for urgent review.

Important Note

Pre-approvals are advisable for planned treatments with significant costs. For emergencies or urgent care, please contact our team to discuss alternative options for claim processing.

The exclusion periods are:

- 1 Day Exclusion Period for Accidental Injury (except Specified Conditions)

- 14 days Exclusion Period for Illness (except Specified Conditions)

- 14 days Exclusion Period for Dental Illness for pets under 1 year old

- 6 months Exclusion Period for Dental Illness for pets 1 year and older

- 6 months Exclusion Period for Behavioural Conditions

- 6 months Exclusion Period for Specified Conditions

Special Considerations by Pet Types

Pet Insurance for Puppies and Kittens

Starting your pet insurance when your pet is young and healthy could minimise the chances of your pet having any pre-existing symptoms and conditions that may not be covered later. Insuring them early can help to ensure they receive extensive coverage without the worry of expensive vet bills.

Starting early with Petsy Pet Insurance has its perks. For pets starting their protection with us before they’re 6 months old, we’ve topped up your chosen annual limit by 20% and you pay nothing extra.

That’s an extra $1,000 on a $5,000 plan

Or an extra $2,000 on a $10,000 plan

Or an extra $5,000 on a $25,000 plan

For pets starting their protection with us before they turn one, we’ve topped up your chosen annual limit by 10% and you pay nothing extra.

That’s an extra $500 on a $5,000 plan

Or an extra $1,000 on a $10,000 plan

Or an extra $2,500 on a $25,000 plan

Pet Insurance for Older Pets

If you’ve adopted an older pet, chances are your new friend will have at least one or two existing health issues, even if they’re fairly minor and under control. Older pets need extra love and attention and taking in an older pet means potentially bearing the high cost of caring for them as well. Whilst pet insurance can’t cover pre-existing symptoms and conditions, it can still be a lifeline in avoiding potentially large vet bills and be your ticket to affording the level of care for any new health issues or accidental injuries that arise.

Pet Insurance for Adopted Pets

Pet insurance works in the same way for adopted pets as it does for other pets. However, when you make your first claim, we may ask for a bit of extra documentation, such as your pet’s adoption certificate.

Pre-existing symptoms and conditions and Coverage

What does Petsy Pet Insurance cover?

Petsy Pet Insurance covers almost every type of accidental injury, illness or condition unless it is specifically listed as not covered. This is why it’s important to know what’s not covered by pet insurance.

When reading the Product Disclosure Statement (PDS), the Summary of Benefits section refers to what’s covered, and the Summary of Exclusions section details what’s not covered under the policy.

Petsy Pet Insurance is for unexpected accidental injuries and illnesses after your exclusion periods have ended. Preventative and elective treatments such as vaccinations, desexing or regular health check-ups aren’t covered.

We aim to provide coverage for over a thousand different accidental injuries, illnesses, and conditions as long as they are not pre-existing and you’ve passed the exclusion periods symptom-free.

Your pet insurance policy might come in handy if, for example, your pet accidentally breaks a bone, or gets hurt by a car, or accidentally swallows something they shouldn’t have. Having a pet insurance in place can help you to cover a portion of these unexpected costs, making it easier for you to access veterinary treatments for your pet without money being the sole deciding factor.

What is a Pre-existing Condition?

A pre-existing condition is a health issue (including any sign of symptoms of that health issue) that existed before your pet insurance policy’s exclusion periods end. Most providers don’t cover pre-existing symptoms and conditions, which means if your pet had a health issue before the insurance coverage began, it won’t be covered.

Temporary vs Chronic Pre-existing symptoms and conditions

There are two types of pre-existing symptoms and conditions:

- Temporary conditions that can be fully resolved and no longer be relevant to your pet’s ongoing health.

- Chronic conditions that require repeat veterinarian visits, ongoing medication and treatment or recurrence of conditions, such as recurrent ear infections.

A temporary Pre-existing Condition is considered to be any condition that has been experienced by a pet for a period of time but is no longer present as a result of treatment. Broken bones, soft tissue injuries, vomiting and diarrhoea all count as potential temporary pre-existing symptoms and conditions. Temporary pre-existing symptoms and conditions are assessed on a case-by-case basis, and you can apply for a review, provided there are no signs or symptoms of the condition during the applicable review period.

A chronic Pre-existing Condition is considered to be any condition which is current before the starting date of the policy (including exclusion periods), ongoing and lifelong condition. Examples of chronic pre-existing symptoms and conditions include cancer, recurrent ear infections, epilepsy, arthritis, heart disease, kidney disease and hip dysplasia. Chronic pre-existing symptoms and conditions are excluded from cover for the life of the policy.

How Does a Pet Insurance Company Identify a Pre-existing Condition?

There are 2 main considerations that determine whether a condition is considered as pre-existing condition:

- The dates that signs or symptoms of the condition first appeared – eg. noted down by your vet in your pet’s medical history; and

- Whether such dates were before or after the exclusion periods on your policy ended.

A Pre-existing symptom and condition in your pet is identified largely based on their medical history. This includes any signs, symptoms, or diagnoses of an injury or illness that occur before the end of your policy’s exclusion periods.

Pre-existing symptoms and conditions also include conditions that are:

- Bilateral – this refers to conditions that can affect both sides of your pet’s body, such as ear infections, cherry eye, cataracts, hip dysplasia, luxating patella’s or cruciate ligament conditions. If one side of the body shows signs of a bilateral condition before your coverage kicks in, your pet won’t be covered if the condition later affects the other side.

- Related, secondary to, or occur as a result of, the initial condition – for example, if your pet has diabetes as a Pre-existing Condition, then cataracts wouldn’t be covered because it’s a secondary condition triggered by the first Pre-existing Condition, as pets with diabetes are predisposed to developing cataracts.

Understanding the Impact of Pre-existing symptoms and conditions and Symptoms on Coverage

You can still insure your pet even if they have pre-existing symptoms and conditions or after the diagnosis of an illness, however, you won’t be able to claim for any treatments related to any pre-existing symptoms and conditions. You will still be able to claim for other new and unrelated conditions that are not pre-existing symptoms and conditions, provided your pet has passed the applicable exclusion periods for those conditions.

Switching Providers: What you Need to Consider

You can switch pet insurance providers at any time. However, there are some important things to keep in mind as switching can impact your pet’s coverage.

What can happen to your pet’s coverage if you switch?

If your pet has coverage for certain health conditions under your current policy, these conditions may not be covered by your new provider as they may be considered as pre-existing symptoms and conditions under the new policy.

Pre-existing symptoms and conditions aren’t generally covered under pet insurance, as pet insurance is designed to help to cover new injuries and illnesses that arise after the exclusion periods end on a new policy. It’s important to review your current coverage and compare it with the new provider’s coverage, so that you don’t lose out on coverage.

This can be particularly important if your pet is dealing with a chronic condition as switching coverage could mean losing coverage for that condition.

Tip: Investing your time to learn more about the existing and the new policies, when deciding on the right provider, can help to avoid being stuck later down the track.

How to Make the Most of your Pet Insurance

Claims Process & Submitting Claims

To make the most of your pet insurance, it’s important to understand the claims process with the provider you choose. Generally, after your pet receives treatment, you’ll need to pay the vet, then submit a claim with your insurer.

Common Pitfalls to Avoid

Understanding your pet insurance policy and the claims process can prevent disappointment later on. Common pitfalls include incomplete paperwork when submitting claims and not being aware of exclusions or limitations in your coverage. Being familiar with your policy details can help you avoid surprises and make the most of your insurance. Also, check with your insurance provider if they have options available to help streamline future claims.

If your claim is denied, it’s typically due to these reasons:

- Submitting a claim within an exclusion period – Your pet isn’t covered the moment you buy your policy. Your policy has different exclusion periods that need to be passed symptom-free before coverage begins.

- Submitting a claim for a pre-existing condition – pre-existing symptoms and conditions aren’t covered if any signs or symptoms of those conditions occurred before the exclusion periods ended.

- Submitting a claim for a non-covered item – Pet insurance is designed to help with unexpected vet costs. Preventative, elective or routine treatments including regular health check-ups, vaccinations and desexing aren’t covered.

Renewing Your policy: Key Factors

Pet insurance premiums might change over time and there are some factors that can affect your premiums at renewal.

- Your Pet’s Age: Just like humans, as pets age, their healthcare needs can become more complex and frequent. Premiums can be adjusted to account for these anticipated changes in medical expenses.

- Rising Veterinary Costs: The cost of veterinary care and treatments increase due to several factors, including general economy wide inflation and increased prices for medical supplies and equipment. As the cost to provide health services for pets increases, insurance premiums may also need to be adjusted to cover these rising expenses.

- Advancements in Veterinary Care: New medical treatments and technologies are continually being developed, which can lead to your pet enjoying a higher quality of care. These can include innovative surgeries, new medications, or state-of-the-art imaging technologies. While these advancements can be life-saving, they often come at a higher cost, which can influence the price of insurance coverage.

- Industry Trends: The pet insurance industry is always evolving. Changes in the overall market and regulatory compliance costs can affect how premiums are set.

- Inflation: Just like in other areas of the economy, inflation impacts veterinary services and pet care costs, which can be reflected in your premium as the costs for vet care and services rise.

- Location and Breed Trends: Where you live and the breed of your pet can also impact your insurance costs. Insurance premiums may be adjusted based on the collective health data of pets similar to yours in your area to more accurately reflect the risk and cost of providing care.

Your pet may need different coverage as they age, so reassessing options can help ensure you have the right protection.

Setting Yourself Up for Pet Insurance Success

How to be prepared for emergencies

Emergencies can happen anytime, so it’s important to have a plan in place. Keep your vet’s contact information, a 24-hour emergency clinic contact details, and your pet insurance policy number in an easily accessible location. Ensure your policy covers emergency visits and have an emergency fund to cover upfront costs before your claim is processed.

Navigating vet visits with insurance

When visiting the vet, let them know you have pet insurance. Ask for detailed invoices and make sure you have all the necessary paperwork to submit a claim. Familiarising yourself with your pet insurance claim process so you’re across the information required to avoid delays.

After your pet has received treatment, you can usually ask your vet to submit the claim for you when you’re at the clinic, by providing your policy number or asking the clinic to submit the invoice or history through to your insurance provider.

Getting the most out of your policy

To make the most out of your pet insurance, understand what’s covered and what’s not. Staying organised with medical records and policy details can streamline claims assessment process. Regular vet check-ups can also help identify health issues early, reducing the risk of them becoming serious and avoiding expensive vet bills later on.

FAQs

Coverage FAQs

What does Pet Insurance cover in Australia?

Pet insurance in Australia is designed for the unexpected events, such as accidental injuries and illnesses. Most policies generally do not cover routine care items, like desexing or teeth cleaning. The types of coverage typically include:

- Accident-Only Cover: Covers costs related to accidental injuries like fractures and broken bones, but excludes illnesses.

- Accident and Illness Cover: A more comprehensive plan covering accidental injuries and illnesses, including hereditary issues, Intervertebral Disc Disease (IVDD), cancer treatment, and chemotherapy.

- Add-ons for Routine Care: Some plans allow you to add routine care, covering vaccinations, desexing, and flea treatments.

Petsy Pet Insurance covers almost every type of accidental injury, illness or condition unless it is specifically listed as not covered. This is why it’s important to know what’s not covered by pet insurance.

Can you claim desexing on pet insurance?

At Petsy, we don’t cover the cost of desexing (spaying or neutering) for your pet. However, if your pet needs treatment for complex cryptorchidism (undescended testicles) and it’s not a pre-existing condition, we can help to cover those vet costs.

Costs and Premiums FAQs

What affects the cost of your premium?

The cost of your pet insurance premium is influenced by several factors. Here are the key factors that typically affect your premium:

- Pet Specific Factors:

- Species and Breed: The breed of your pet can significantly impact the premium. Some breeds are more prone to specific health issues, which can make them more expensive to insure. For example, larger breeds like Labradors and German Shepherds may be more prone to joint issues, while smaller breeds like Pugs and Bulldogs might have respiratory problems

- Pet’s Age: Generally, younger pets have lower premiums. As your pet gets older, the chances of developing health issues increase, which can raise the premium cost

- Location: Where you live can affect your premium, as vet costs may vary by region. Areas with higher living costs may lead to higher premiums

- Sex of Your Pet: The sex of your pet can influence their behaviour and health risks, which may affect the likelihood of claims. This is factored into risk assessments by insurers

- Coverage Options:

- Coverage Options: The level of coverage you choose directly impacts the premium. A higher annual limit, benefit percentage, and/or lower excess will typically result in higher premiums

- Optional Extras: Adding optional benefits, such as coverage for dental illness or specialised therapies, will increase the premium

By adjusting some of these, such as choosing a higher excess or lower annual limit, you can find ways to reduce the cost of your premium.

What is the average cost of pet insurance in Australia?

According to MoneySmart, pet insurance premiums typically range from $60 to $120 per month. This means that there is a lot of variation in the market for the levels of coverage that are offered. It’s important to compare pet insurance policies and understand what coverage is included at a certain price point. Please take this range as a rough guide, as factors specific to your pet such as breed, age, sex and your location will affect your premiums. Factors like breed, age, and location affect your premium, so you should focus on what’s specific to your pet, rather than comparing to the industry average. Sometimes, whether you have made a claim or how many claims you made, can affect your premiums (at Petsy, we don’t consider these, when determining your premium).

How can I lower my pet insurance premiums?

To lower your pet insurance premiums, you can adjust several aspects of your coverage. Petsy offers one customisable policy to allow you to lower your premiums to meet your budget. Here are a few strategies:

- Choose a Higher Excess: Increasing the excess (the amount you pay out-of-pocket before your insurance kicks in) can reduce your premium significantly. For example, at Petsy, a $500 annual excess option can reduce premiums by over 40% in some cases

- Lower Your Annual Limit: The annual limit is the maximum amount your insurer will pay for claims in one year. Lowering this limit will reduce your premium. For instance, Petsy offers limits like $5,000, $10,000, and $25,000, with the lowest limit having the lowest premium

- Adjust the Benefit Percentage: The benefit percentage is the portion of eligible vet bill your insurance will cover (e.g., 80% or 90%). Opting for a lower benefit percentage can help lower your premium

- Remove Optional Extra Benefits: Optional benefits like coverage for dental illness, specialised therapies, and behavioural conditions can increase your premium. Removing these extras, especially if your pet doesn’t need them, can reduce your premium

- Exclude Vet Consultations from Your Coverage: Petsy allows you to exclude vet consultation fees from your coverage, which can lower your premium. This may be a good option if you already receive discounted vet consultations or if you’re on a wellness plan which covers vet consultation fees

By adjusting these variables, you can customise your pet insurance to balance your budget with the level of coverage you need.

Is it better to have a higher excess pet insurance?

A higher excess can lower your premiums, but it means you’ll need to pay more out-of-pocket expenses, before insurance covers eligible expenses. A lower excess reduces the amount you need to pay but comes with higher premiums.

What is the cheapest and best pet insurance?

Accident-only cover is usually the most affordable pet insurance option, with premiums starting from $20-$30 per month for dogs and even lower for cats. However, this cover may not include situations you normally expect to be covered, like when a pet swallows a foreign object, which is often classified as an illness, not an accident.

Petsy no longer offers accident-only policies because such policies provide limited coverage that can be confusing and insufficient during emergencies. Instead, we provide customisable accident and illness plans that allow you to adjust coverage options like the annual excess to reduce your premiums. By increasing the annual excess, you can lower your premium—our $500 excess option can reduce premiums by over 40% in some cases.

Choosing the Right Insurance FAQs

How do I know which pet insurance is best for me?

Choosing the right pet insurance depends on your pet’s health needs and your budget. Not all policies are created equal and it’s important to understand what each policy covers and how that compares with the price. The cheapest option may not necessarily provide the most value. Here’s a breakdown of key components.

- Coverage Type: Accident-only policy covers accidental injuries, while accident and illness policy covers both injuries and illnesses. Add-ons for routine care are also available.

- Annual Limit: This is the max amount your insurance will pay each year—higher limits offer more coverage but come with higher premiums.

- Benefit Percentage: This is how much of each eligible vet bill your insurance will cover (e.g., 80%).

- Excess (Deductible): The out-of-pocket amount you pay before insurance will start to cover costs. Some plans have an annual excess, while others have per claim or per condition excess.

- Add-Ons or Optional Extra Benefits: Additional coverage for dental illness or specialised therapies may be worth considering.

Which level of pet insurance is the best?

The coverage level of pet insurance that is best for you and your pet, is really dependent on your needs and what fits your budget. Higher coverage comes at a cost of higher premiums.

Pet insurance is very specific to your pet. So, consider factors like your pet’s age and breed. For example, different breeds have varying risks and predispositions to certain health conditions. Some breeds are more prone to certain illnesses or genetic conditions. For example, larger breeds like Labradors and German Shepherds are more susceptible to joint issues like hip dysplasia, while smaller breeds such as Pugs or Bulldogs can have breathing problems. These breed-specific risks can increase the likelihood of needing costly treatments. Some breeds are more expensive to treat due to the type of care they may require. For instance, surgery for large breeds can be more expensive because they require larger doses of anaesthesia, more medication, and longer recovery times.

How do I know which pet insurance is the best for me?

The best pet insurance will be the insurance that meets your financial and coverage needs and provides support to you when you need it. You can check out third-party sources like Forbes Advisor, Canstar, and Mozo, that offer expert reviews and awards. Customer reviews from platforms like ProductReview.com.au and TrustPilot can also give you real insight into how different providers handle claims and customer service.

Is it worth shopping around for pet insurance?

Yes, shopping around for pet insurance quotes is definitely worthwhile. Providers offer different coverage levels at various price points, so comparing policies helps you make an informed decision. Most policies have key components like annual limits, benefit percentages, excess, and optional extras. Understanding how these components differ across providers will help you find the best value and coverage for your pet’s needs. Remember, pet insurance policies are not created equal. This helps you identify the best policy that meets your coverage needs and offers the most value. We walk you through how to compare pet insurance policies, “apples with apples”, in this guide.

Pet-Specific FAQs

What age is best to get pet insurance?

The best time to get pet insurance can be as early as possible, to reduce the chance of your pet developing pre-existing symptoms and conditions and symptoms, which are excluded from coverage. Pet insurance is designed for the unexpected, so early coverage can save you on future vet expenses.

What factors should I consider about my pet’s breed and age?

You should consider your pet’s breed and age when deciding the type of coverage you need and the potential cost. Here are the factors to consider about your pet’s breed and age:

Breed-Related Factors:

- Breed-Specific Health Risks:

- Certain breeds are more prone to specific health conditions, which can affect the likelihood of needing certain expensive treatments.

- Large breeds like Labradors and German Shepherds are more prone to joint issues like hip dysplasia, which can lead to costly surgeries

- Small breeds such as Pugs and Bulldogs may face respiratory problems due to their flat faces (brachycephalic syndrome). Please note Petsy Pet Insurance does not cover vet costs related to brachycephalic syndrome until the Petsy Brachycephalic Obstructive Airways Syndrome (BOAS) Application form is submitted and accepted by us.

- Genetic predispositions: Some breeds are more prone to hereditary conditions like Intervertebral Disc Disease (IVDD), heart disease, or luxating patella

- Cost of Different Treatment by Breed:

- Some breeds are more costly to treat due to the complexity of the care they require. For example, surgery for larger breeds may involve higher doses of anaesthesia, more medication, and longer recovery times

- Smaller breeds might need specialised treatments for conditions like dental issues or breathing problems

Age-Related Factors:

- Young Pets (Puppies and Kittens):

- Early Coverage: Starting coverage when your pet is young helps avoid exclusions for pre-existing symptoms and conditions, as younger pets are less likely to have developed serious health issues

- Bonus for Early Sign-Up: At Petsy, pets that are insured before their first birthday receive an annual limit bonus at no extra cost, making early coverage even more beneficial

- Older Pets:

- Increased Health Risks: As pets age, they are more likely to develop chronic conditions such as arthritis, diabetes, or heart disease, which can lead to higher premiums

- Insurance Limitations: Some insurers have age limits for entry. For example, Petsy Pet Insurance covers pets up to 9 years old for new policies, but once a policy is active, it can continue as long as you renew your policy

- Adopted Pets:

- For adopted pets, especially older ones, it’s important to consider whether they may already have pre-existing symptoms and conditions that could affect coverage

By taking into account your pet’s breed and age, you can select the best insurance plan that matches their specific health risks and needs, helping you avoid or reduce unexpected costs down the line.

Pet Insurance Value and Usage FAQs

How do I get the most out of my pet insurance?

To maximise your pet insurance coverage, start early to avoid pre-existing symptoms and conditions being excluded. Petsy policies can start for pets aged between 6 weeks and 9 years, and coverage continues as long as you renew. Avoid switching providers, if previous claims related conditions can be considered pre-existing symptoms and conditions by a new insurer. At Petsy, we like to reward responsible pet ownership by giving puppies and kittens an annual limit bonus of up to 20% at no extra cost, if you sign up before your pet’s first birthday.

Is Pet Insurance a waste of money?

Pet insurance isn’t a waste of money for most pet owners, especially if you want someone else to help pay for your unexpected vet bills. Vet care can be expensive, and without insurance, you’re responsible for 100% of the costs, 100% of the time. For example, emergency treatments, surgeries, or long-term care for chronic conditions can easily add up. Pet insurance can ease the financial burden, allowing you to focus on your pet’s well-being rather than costs.

If you’re able to cover high vet bills out of your own pocket, you might question its value, and there are alternatives to pet insurance. Ultimately, it depends on your financial situation, your pet’s health, and your risk tolerance for unexpected medical expenses.

How does pet insurance work with pre-existing symptoms and conditions?

Pet insurance generally does not cover pre-existing symptoms and conditions, which are health issues that your pet had before the policy’s waiting or exclusion periods ended.

Definition of Pre-existing symptoms and conditions:

- A pre-existing condition is any injury, illness, or symptom that your pet experienced before your pet insurance policy became active or before the waiting/exclusion periods ended.

Types of Pre-existing symptoms and conditions:

- Temporary Pre-existing symptoms and conditions:

- These are conditions that can be fully resolved and may no longer affect your pet’s health after treatment. Examples include broken bones, soft tissue injuries, or short-term vomiting and diarrhoea.

- Many insurance providers, including Petsy, allow for temporary pre-existing symptoms and conditions to be reassessed after a certain period without symptoms. If a condition remains symptom-free during the applicable review period, you may be able to get coverage for it in the future.

- Chronic Pre-existing symptoms and conditions:

- These are ongoing or lifelong conditions, such as cancer, arthritis, heart disease, or diabetes. Chronic conditions typically require continuous treatment and care, and they are usually excluded from coverage for the life of the policy.

- How Pre-existing symptoms and conditions are Identified:

- Pre-existing symptoms and conditions are identified based on your pet’s medical history and the timing of any symptoms. Insurers look at whether any signs of illness or injury occurred before the end of the policy’s waiting/exclusion periods.

- Bilateral conditions may also be excluded. If a condition affects one side of the body before the waiting/exclusion period ended, the insurer may exclude coverage if it later affects the other side (eg. hip dysplasia, cruciate ligament issues, cataracts).

- Impact on Coverage:

- If your pet has a pre-existing condition, pet insurance will not typically cover any treatments related to that condition. However, you can still get coverage for new and unrelated conditions that arise after your policy becomes active and the waiting/exclusion periods have passed.

- Assessing Pre-existing symptoms and conditions:

- Some insurance providers, including Petsy, offer pre-existing condition assessments to determine which conditions may be excluded from coverage. This assessment is based on review of your pet’s vet treatments history.

In summary, while pre-existing symptoms and conditions are typically not covered, some conditions can be reassessed and may become eligible for coverage if they are resolved over time. However, chronic or ongoing pre-existing symptoms and conditions will remain excluded from your policy.